virginia state ev tax credit

The fee is included with registration fees and must be paid at the time of original registration and each year at renewal. Federal and State Electric Car Tax Credits Incentives Rebates.

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia.

. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle. Local and Utility Incentives. A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate 2.

Points of Contact Get contact information for Clean Cities coalitions or agencies that can help you with clean transportation laws incentives and funding opportunities in Virginia. Virginia lawmakers have put forward House Bill 469 which would allow for a 10 State tax refund on the purchase of an electric vehicle up to. In President Bidens State of the Union address the President voiced support for revisiting EV tax credits in 2022.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. The Fund shall be established on the books of the Comptroller. Reference House Bill 443 2022 and Virginia Code 56-121 and 56-23221.

Virginia Electric Vehicle Tax Credit 2022. Electric Vehicles Solar and Energy Storage. An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia.

Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. Reid D-32nd would have granted a state-tax rebate of up to 3500. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

Clean Cities Coalitions Virginia is home to the following Clean Cities. Virginia isnt the only entity that aims to incentivize the ownership of electric models. A bill proposed in mid-January by Virginia House Delegate David A.

Light duty passenger vehicle. The annual highway use fee will be updated yearly on July 1. The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV.

If the purchaser of an EV has an income that doesnt exceed 300 percent of the federal poverty level they can get an extra 2000 on their. Medium duty electric truck. Federal government also has credits and perks for you to take 2.

The MSRP for new vehicles and the Kelly Blue Book value for used must not exceed 50000 in order to qualify for a rebate. If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500. Heavy duty electric truck.

The Virginia State Corporation Commission may not set the rates charges or fees for retail EV charging services provided by non-utilities. There is hereby created in the state treasury a special nonreverting fund to be known as the Electric Vehicle Rebate Program Fund. Beginning September 1 2021 a resident of the Commonwealth who is the purchaser of a new or used electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500 subject to the availability of funds in the Fund.

In addition to broad-scale electric vehicle incentives states and utilities provide incentive programs rebates and tax credits specifically for purchasing and installing EV charging equipment across the country. 10th 2018 330 pm PT. Light duty electric truck.

Several months later it seems that revisions to the credit are returning to lawmaker agendas. Consumers who purchase qualified residential charging equipment prior to December 31 2021 may receive a tax credit of 30 of the cost up to 1000. Drive Electric Virginia is a project of.

Virginia State And Federal Tax Credits For Electric Vehicles Pohanka Chevrolet. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. Beginning September 1 2021 a qualified resident of the Commonwealth who is the purchaser of a new.

Effective October 1 2021 until January 1 2027 Electric Vehicle Rebate Program Fund. And it says Enhanced Rebate for Qualified Resident of the Commonwealth which is defined in the header at someone who makes less than 300 of the poverty line. There are federal programs that when you purchase a fully electric vehicle you get a 7500 tax credit so that also helping the environment greater.

Electric vehicles that get 200 or more miles of range would qualify for a 2000 rebate for new and 1000 for a used vehicle. The current credit offered to ev buyers is for up to 7500 usd and is set to increase if the bill passes in the senate. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

You may be able to get a maximum of 7500 back on your tax return. Aftermarket Electric Vehicle EV Conversion Regulations. A vehicle that gets between 120 and 200 miles qualifies for 1500 for new and 750 for used.

Federal Tax Credit. Expired Repealed and Archived Laws and Incentives View a list of expired repealed and archived laws and incentives in Virginia.

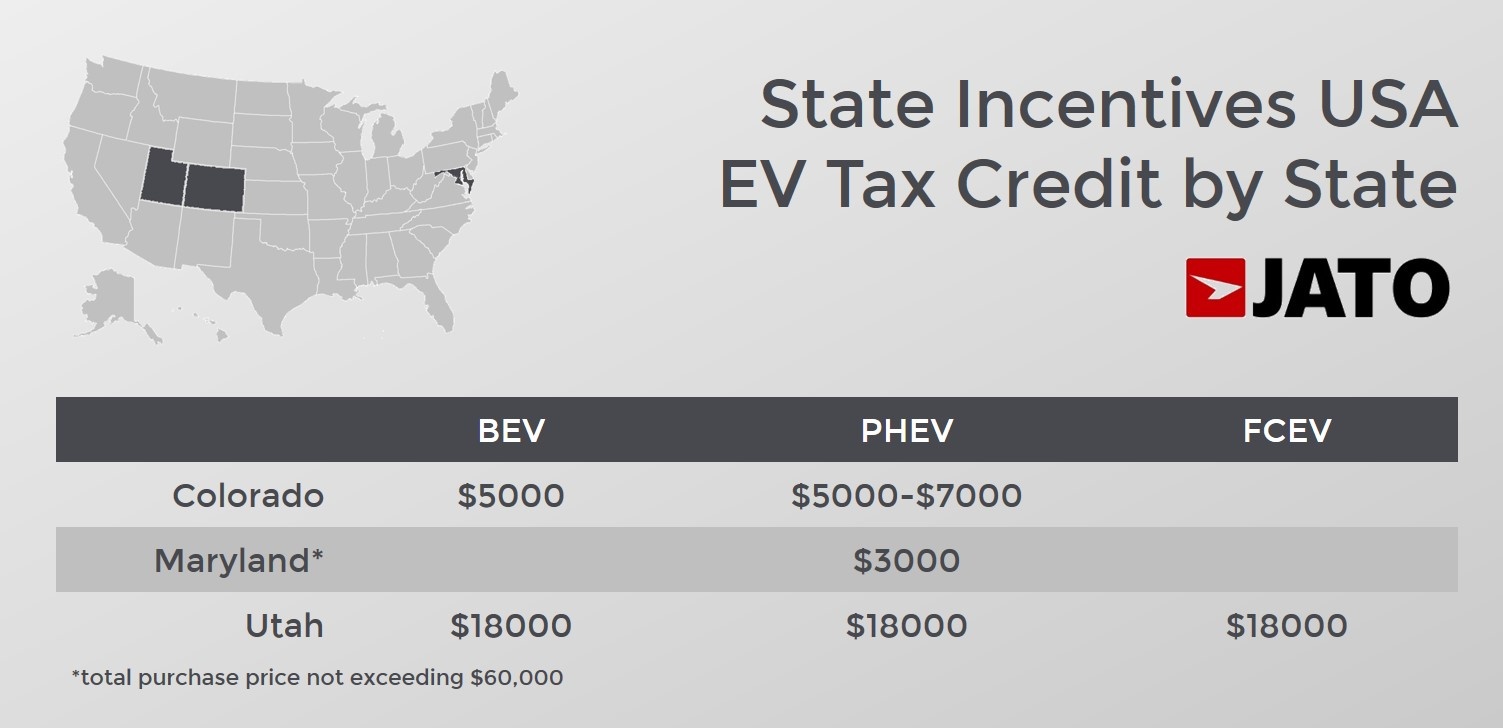

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

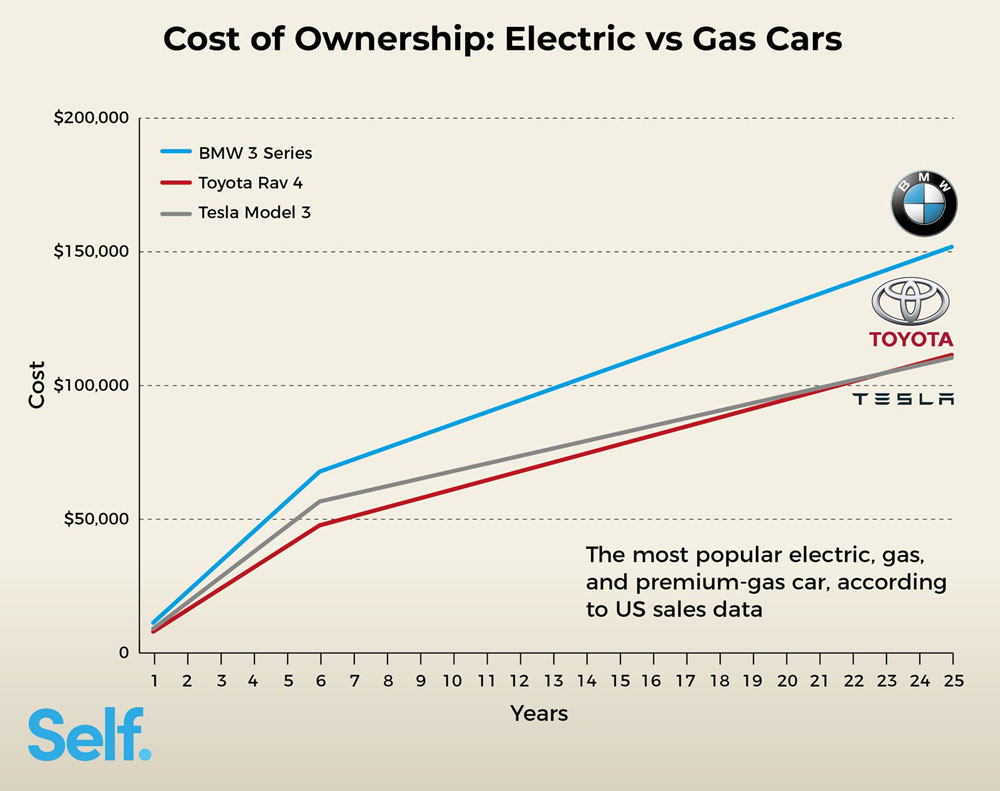

Electric Cars Vs Gas Cars Cost In Each State Self Financial

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Tax Credits Drive Electric Northern Colorado

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Honda Of Chantilly

How To Calculate The Federal Tax Credit For Electric Cars Greencars

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Evs Cheaper Than Gas Powered Cars In Us Depending On State Incentives Pv Magazine International

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Andre On Twitter General Motors Vehicules Electriques Voiture Electrique

Biden S Electric Vehicle Plan Faces Jam From Cultural Divide 2022 02 03 Supplychainbrain

Evs Cheaper Than Gas Powered Cars In Us Depending On State Incentives Pv Magazine International

Latest On Tesla Ev Tax Credit March 2022

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Key Senator Questions Need For Expanding U S Ev Tax Credit Reuters